In today’s fast-paced business world, staying ahead of the curve requires leveraging technology to its fullest potential. New financial tools are emerging constantly, offering businesses a powerful arsenal to optimize efficiency, gain valuable insights, and ultimately, boost their financial health.

This guide dives into the world of new finance tools, highlighting an effective option – PocketGuard!

Why Choose Pocketguard?

PocketGuard goes beyond basic budgeting. It tracks spending, identifies areas for saving, negotiates bills on your behalf (in the US only), and even monitors your credit score.

Whether you're a solopreneur or manage a growing team, PocketGuard adapts to your needs. Its intuitive interface and range of features empower you to take control of your finances, regardless of your business's complexity.

If you’re looking to get your fianaces in check but are not ready to fully commit, pocketguard is your best bet. You can check out the free version, although it has limited functions, it gives you a great template for what to expect from the paid version. And when, youre read to deep dive, Pocketguard will fit in perfectly with your small business and personal finance.

Ditch the Manual Grind and Take Control Forget the days of manually entering transactions and sifting through endless spreadsheets. PocketGuard empowers you with effortless tracking, freeing up your valuable time and energy. Here's how:

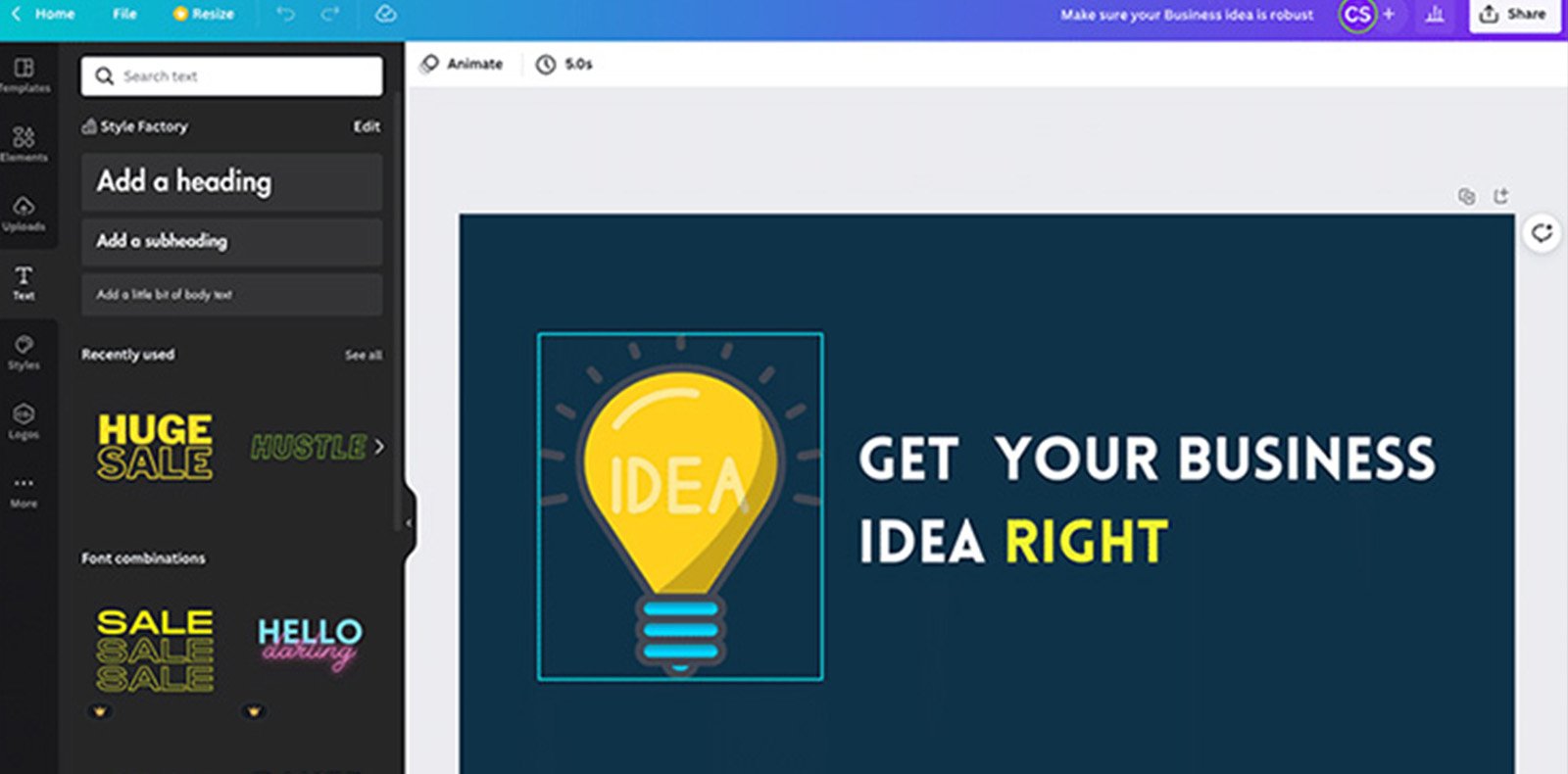

Unveiling Canva Design Like a Pro on a Budget In today's digital age, a captivating online presence is crucial for businesses of all sizes. But.

Unveiling MailChimp Elevate Your Email Marketing Game on Any Budge In today’s digital landscape, effective email marketing is vital for businesses to connect with their.

Say goodbye to tedious categorization! PocketGuard intelligently analyzes your transactions and assigns them to appropriate categories like groceries, gas, or entertainment. This eliminates the need for manual entry and ensures your financial data is organized from the get-go.

Ditch late fees and unnecessary stress. PocketGuard acts as your personal bill reminder system, sending you timely notifications before due dates. This ensures you stay on top of your bills and avoid any negative impact on your credit score.

Unmask hidden subscription fees! PocketGuard scans your accounts and identifies recurring subscriptions you might have forgotten about. This allows you to eliminate unnecessary subscriptions and redirect that money towards your financial goals.

Limited But Strategic While PocketGuard doesn't offer a wide range of integrations compared to some robust accounting platforms, it focuses on strategic connections to enhance its core functionalities. Here's a breakdown of its integration potential:

PocketGuard securely connects to your bank accounts through a verified and encrypted connection. This allows for automatic transaction import, categorization, and overall financial data retrieval.

Some PocketGuard plans allow connecting investment accounts for a more comprehensive financial picture (check specific plan details).

There are currently no official third-party app integrations available for PocketGuard. However, as the platform continues to evolve, developers might introduce integrations with specific services in the future.

PocketGuard allows you to export your financial data in a CSV (comma-separated values) format. This exported data can then be manually imported into other financial tools or spreadsheets for further analysis or integration with specific workflows.

PocketGuard prioritizes user privacy and data security. By focusing on secure bank connections and not offering extensive integrations, they aim to minimize potential security risks associated with third-party connections.

A Visual Guide

PocketGuard goes beyond basic budgeting and offers a comprehensive suite of features to empower you to take control of your finances. Here’s a closer look:

PocketGuard automatically connects to your bank accounts and categorizes your spending, saving you time and effort.

Never miss a due date again. PocketGuard tracks upcoming bills, sends reminders, and even allows you to set up automatic bill pay (in some countries).

Identify and manage recurring subscriptions. PocketGuard helps you identify areas where you might be paying for unused services.

PocketGuard analyzes your bills and negotiates lower rates with cable and internet providers on your behalf (a valuable feature not offered by all budgeting apps).

Set personalized savings goals and track your progress. PocketGuard offers tools to create budgets and monitor your spending against your goals.

Keep an eye on your credit score and receive alerts for any changes (not available in all countries).

PocketGuard provides valuable insights into your spending habits, helping you identify areas where you can save.

PocketGuard boasts a user-friendly interface with a focus on clarity and ease of use. Here’s a quick rundown:

A clear bottom bar lets you access core features: Transactions, Bills, Savings, Insights (may be limited in the free version), and More (settings, support).

View upcoming bills, set reminders, track payments, and even negotiate lower rates (US only, paid subscription).

Set savings goals, gain spending insights (may be limited in free version), and monitor credit score (US only, paid subscription).

Overall, PocketGuard’s UI is clean, visually appealing, and intuitive, making it a breeze to manage your finances.

Offers basic budgeting features like:

Offers all features of the free plan, plus:

Challenge: Sarah, a recent college graduate, landed her first job as a freelancer. She’s excited but overwhelmed by managing her student loans, monthly bills, and newfound financial freedom. Budgeting feels like a chore.

Pocketguard Solution: Sarah downloads Pocketguard and connects her bank accounts. Pocketguard automatically categorises her income and expenses, giving her a clear picture of her cash flow. The “Bills to Pay” section ensures she never misses a due date, and Pocketguard identifies potential areas to save based on her spending habits. Sarah can set realistic budgets for groceries, entertainment, and loan repayments, receiving alerts if she nears her limits. Pocketguard empowers her to become financially responsible and avoid unnecessary debt.

Challenge: David, a marketing manager, juggles a demanding job and a family. Keeping track of finances amidst a hectic schedule proves difficult. He often forgets upcoming bills and misses out on saving opportunities.

Pocketguard Solution: David utilises Pocketguard’s “Find Subscriptions” feature. Pocketguard scans his accounts and identifies recurring subscriptions he might not even remember. This helps him eliminate unused subscriptions and save money. Pocketguard’s “Unused Bills” feature alerts him if there are unspent bill funds he can potentially allocate towards savings goals. The intuitive interface allows David to quickly check his account balances and upcoming expenses on his phone, even during busy days. Pocketguard becomes his financial management assistant, simplifying budgeting and saving him valuable time.

Challenge: Maria, a seasoned entrepreneur, meticulously tracks her finances. However, managing multiple bank accounts and investment accounts becomes cumbersome with traditional spreadsheets.

Pocketguard Solution: Maria connects her various accounts to Pocketguard. The platform aggregates her financial data in one place, providing a holistic view of her overall financial health. Pocketguard’s “Insights” section offers personalised recommendations to optimise her spending and saving strategies. Maria leverages Pocketguard’s ability to track investments and monitor their performance, allowing her to make informed financial decisions for both her business and personal finances. Pocketguard empowers her to maintain control and optimise her multifaceted financial situation.

+1 (704) 430-6476

info@scumscenariomaster.com

Copyright © 2024 Apprentistly