In today’s fast-paced world, freelancers and self-employed individuals face unique challenges. Managing finances efficiently is crucial for success, but juggling everything yourself can be overwhelming. This is where financial tools like Oxygen come in.

Why Choose Oxygen?

Oxygen adapts to your evolving business. As you take on more clients or diversify your income streams, Oxygen scales up or down with you. Need to add features for managing project expenses? No problem. Your business slows down for a season? You can easily adjust your plan accordingly.

Manage multiple income streams and expenses with ease. Oxygen seamlessly grows with your business, allowing you to categorize income from different projects, clients, or platforms effortlessly.

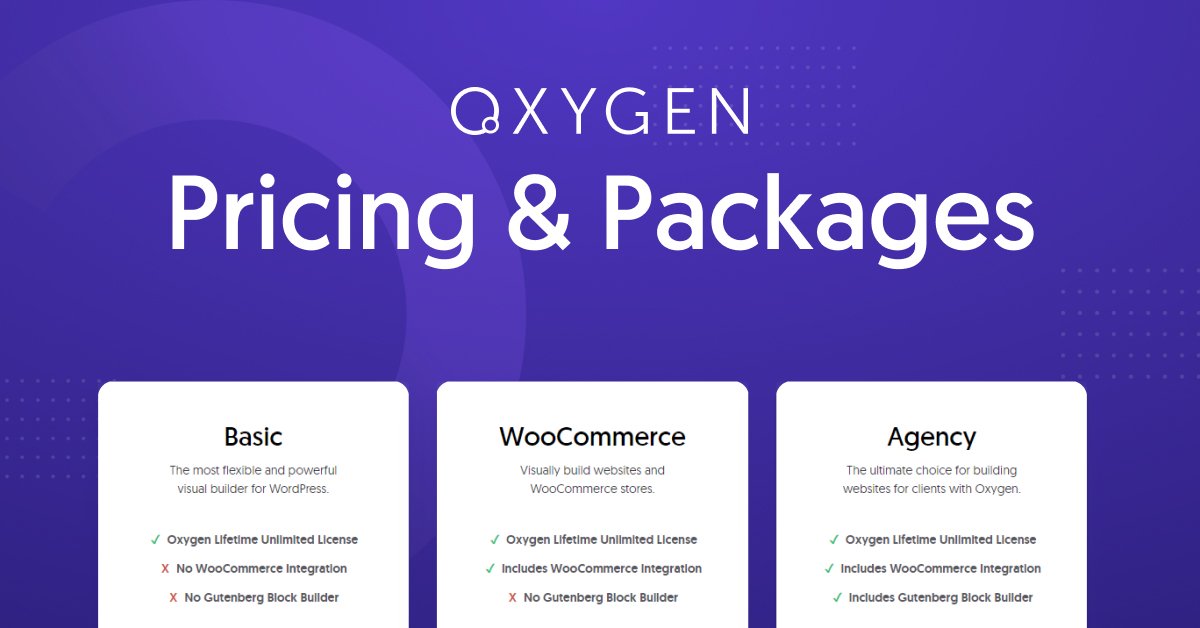

Enjoy competitive pricing plans designed specifically for freelancers on a budget. Oxygen understands that freelancers often have fluctuating income, so they offer plans that cater to your financial needs.

Forget complex accounting software with steep learning curves. Oxygen's intuitive interface makes getting started and managing your finances a breeze. Their user-friendly platform ensures you can navigate features, track expenses, and generate reports without any accounting expertise.

Integrate your existing business tools for a unified financial experience. Whether you use popular invoicing software, project management apps, or specific tax filing services, Oxygen can connect with them to create a seamless workflow.

Oxygen's strength lies in its ability to streamline your freelance finances by integrating seamlessly with the tools you already use. Here are some potential integration possibilities to consider:

Unveiling Canva Design Like a Pro on a Budget In today's digital age, a captivating online presence is crucial for businesses of all sizes. But.

Unveiling MailChimp Elevate Your Email Marketing Game on Any Budge In today’s digital landscape, effective email marketing is vital for businesses to connect with their.

Integrate popular invoicing software like Stripe, PayPal Invoices, or FreshBooks with Oxygen. This allows you to automatically import client invoices, track payments received, and reconcile your accounts with ease. No more manual data entry between invoicing and your financial management platform.

Integrate project management tools like Asana, Trello, or Basecamp with Oxygen. This allows you to track project expenses associated with specific tasks or clients directly within Oxygen. You can gain a more granular understanding of project profitability and identify areas for cost optimization.

Simplify tax season by integrating Oxygen with popular tax filing services like TurboTax or H&R Block. This allows you to export your income and expense data directly into your tax filing software, saving you time and ensuring accuracy during tax preparation.

Integrate expense tracking apps like Mint or Expensify with Oxygen. This provides a holistic view of your spending habits, both business and personal. You can categorize expenses automatically, capture receipts digitally, and ensure all your business-related costs are properly reflected in your financial management system.

Connect your bank accounts and payment gateways directly to Oxygen. This allows for automatic transaction imports, real-time account balance updates, and simplified bill payment management.

By integrating Oxygen with these tools, you can:

A Visual Guide

1. Show a user on a laptop screen navigating the Oxygen website.

2. Briefly highlight the “Sign Up” button and the steps involved:

3. Briefly show a confirmation screen and a welcome message.3.

Scene 2: Connecting Bank Accounts

Scene 3: Adding Income

1. Show the user navigating the “Income” section of the dashboard.

Briefly demonstrate adding income by:

2. Show the income being recorded in the dashboard.

Scene 4: Capturing Expenses

1. Show the user adding an expense on the mobile app (illustrate both iOS and Android versions if possible).

2. Briefly demonstrate capturing an expense by:

3. Show the expense being recorded in the app and syncing with the user’s dashboard.

1. Show the user navigating the “Reports” section of the dashboard.

2. Briefly showcase the different report options available (e.g., income vs. expenses, project profitability, tax summary).

3. Allow viewers to see a glimpse of a sample report with clear visualizations (charts or graphs) for easy understanding.

Ditch the spreadsheets and manual data entry. Oxygen allows you to effortlessly track all your income and expenses in one place. You can categorize income from different sources, like client payments, project fees, or platform payouts. On the expense side, Oxygen helps you categorize business-related costs, track mileage, and capture receipts digitally using their mobile app.

Never miss a bill payment again. Set up automatic bill payments for recurring expenses like rent, utilities, or software subscriptions. This ensures your bills are paid on time, avoiding late fees and potential damage to your credit score.

Tax season doesn't have to be a nightmare. Oxygen provides tax optimization tools to help you categorize expenses, identify potential deductions specific to freelance work (like home office expenses or professional development costs), and generate reports for your accountant. This can save you significant time and money come tax time.

Oxygen understands that freelance income can be sporadic. They offer an optional feature for early access to earned income on completed projects. This can bridge cash flow gaps between projects and help you cover unexpected expenses or manage uneven income cycles.

Gain valuable insights with Oxygen's customizable dashboards. Visualize your income and expenses, track project profitability, and monitor cash flow. Generate reports to analyze trends, identify areas for cost savings, and make informed financial decisions for your freelance business.

Oxygen integrates seamlessly with popular freelance platforms and accounting tools you already use. This allows you to import data from invoicing software, project management apps, or specific tax filing services. This creates a centralized hub for all your freelance finances, eliminating the need to manually transfer data between different platforms.

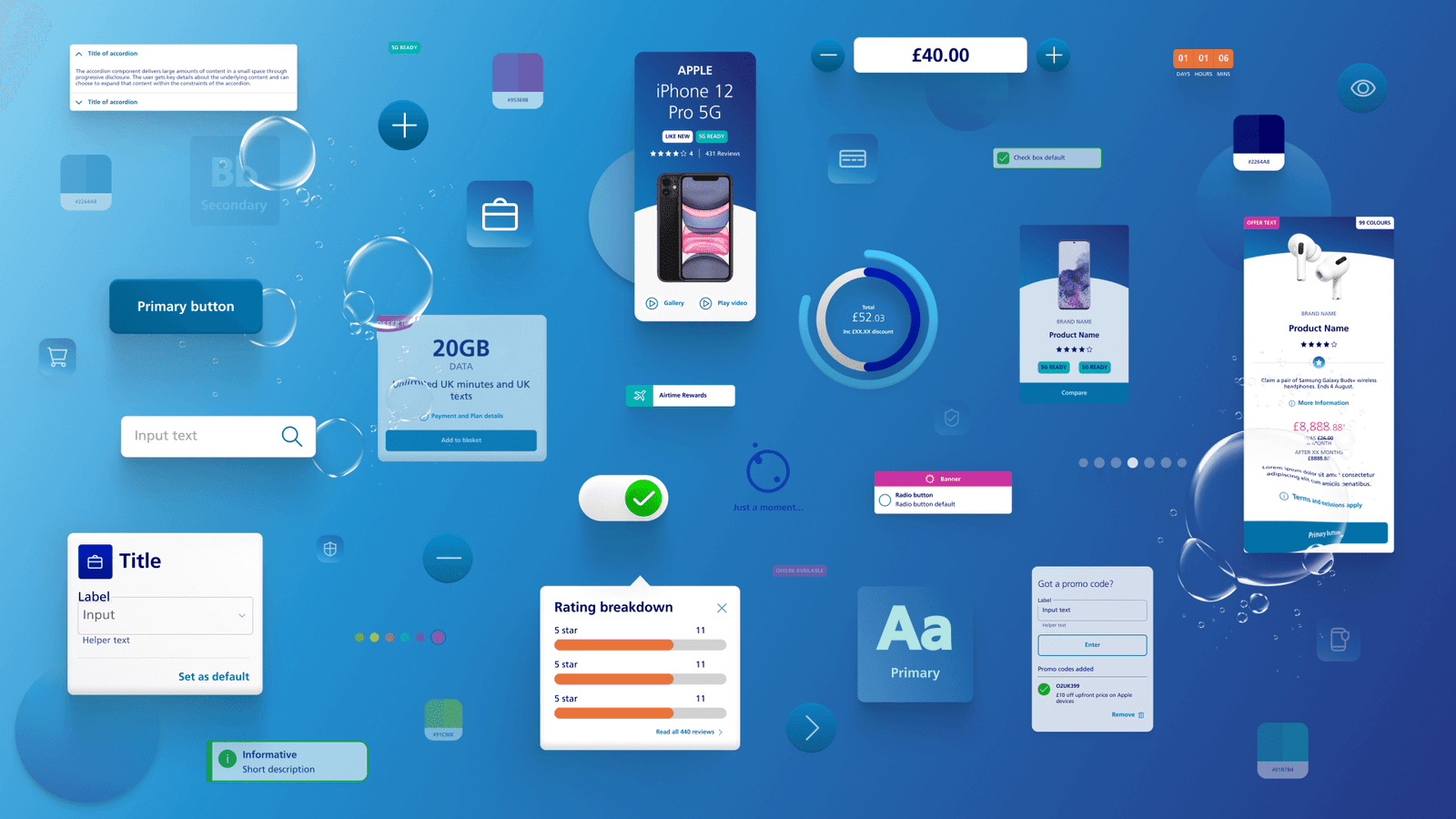

Oxygen’s user interface (UI) is clean, intuitive, and designed for a smooth user experience on any device. Here’s what makes it so user-friendly for freelancers:

A clear and organized layout makes it easy to find the features you need, whether you’re on your desktop computer, laptop, or smartphone app. No more wasting time hunting through menus or getting lost in complex interfaces.

Oxygen uses intuitive data visualization tools like charts and graphs to present your financial data. This allows you to easily understand your income, expenses, cash flow, and project profitability at a glance. No need to be an accounting expert to decipher complex financial reports.

Manage your finances on the go with Oxygen’s mobile app. This allows you to track income and expenses, categorize costs, capture receipts, and monitor your cash flow anytime, anywhere. This is ideal for freelancers who are constantly on the move and need to manage their finances remotely.

Oxygen allows you to personalize your dashboard and reports to prioritize the information most relevant to your freelance business. This ensures you have quick access to the financial insights that matter most to you.

Reach out to Oxygen's customer support team via phone, email, or live chat, depending on your preference.

Get the help you need quickly with a team dedicated to addressing your questions and guiding you through the platform.

Oxygen might also offer a comprehensive knowledge base or frequently asked questions (FAQs) section on their website. This allows you to find answers to common questions or troubleshoot issues independently.

No hidden fees or surprise charges. Oxygen clearly outlines the features and functionalities included in each plan, allowing you to choose the option that best suits your requirements.

Start with a basic plan for simple income and expense tracking, and upgrade as your business grows. This allows you to scale your financial management tools alongside your freelance income and the complexity of your projects.

Many financial tools offer free trials, and Oxygen might be one of them (check their website for details). This allows you to test drive the platform and see if it fits your needs before committing to a paid plan.

Meet Sarah: Sarah is a freelance graphic designer who juggles multiple clients with varying project scopes. She often works remotely and needs a financial management tool that’s accessible and easy to use on the go.

Tracking Income and Expenses: Sarah struggles with keeping track of income from different clients across various projects. She might use spreadsheets or rely on memory, leading to errors and missed income. Additionally, managing project-specific expenses like software subscriptions, stock photos, or contractor fees becomes cumbersome without a centralized system.

Bill Management: With a busy freelance schedule, Sarah finds it difficult to stay on top of deadlines for bills and recurring subscriptions. Missing a payment can lead to late fees and damage her credit score.

How Oxygen Helps:

Effortless Income & Expense Tracking: Oxygen allows Sarah to effortlessly track income from each client in one place. She can categorize income by project, type of service, or client, providing a clear picture of her earnings. On the expense side, Oxygen helps her categorize business-related costs, track mileage for client meetings, and capture receipts digitally using the mobile app. This eliminates the need for manual data entry and ensures accurate record-keeping.

Automated Bill Payments & Reminders: Sarah can set up automatic bill payments for recurring expenses like rent, utilities, or software subscriptions. This ensures her bills are paid on time, avoiding late fees and potential damage to her credit score. Oxygen can also send her reminders for upcoming bills, so she never misses a deadline.

Streamlined Workflow: Oxygen saves Sarah valuable time and reduces stress by automating tasks and centralizing her financial data.

Improved Cash Flow Management: Automated bill payments and clear cash flow insights help Sarah manage her finances effectively, preventing gaps between projects and ensuring she has enough funds to cover operational costs.

Meet David: David runs a small consulting firm with a team of three specializing in web development. They require a tool that can handle multiple users, complex project finances, and integrate seamlessly with their existing workflow.

Team Expense Management: David finds it challenging to manage team member expenses and reimbursements efficiently. Manually tracking receipts and approvals becomes time-consuming and prone to errors as his team grows.

Project Profitability: Without clear visibility into individual project profitability, David struggles to identify the most lucrative projects and optimize resource allocation.

Multi-User Access and Permissions: David can assign team member accounts within Oxygen, allowing them to track expenses, submit receipts for approval, and view project financials based on pre-defined permissions. This ensures transparency, accountability, and simplifies expense management for the entire team.

Project Costing & Profitability Tracking: Oxygen’s project costing features enable David to allocate expenses accurately to specific projects and track profitability for each client engagement. He can see a breakdown of costs associated with personnel, software licenses, travel, and other project-related expenses.

Integration with Project Management Tools: Oxygen integrates seamlessly with popular project management tools like Asana, Trello, or Basecamp. This allows David and his team to track project expenses directly within their existing workflow, eliminating the need for manual data entry and ensuring data consistency across platforms.

Improved Efficiency and Collaboration: By automating expense management and integrating with project management tools, Oxygen streamlines financial processes for David’s team, saving them valuable time and reducing errors.

Meet Liam: Liam is a freelance writer with a variable income stream. He often experiences periods of feast or famine in terms of project income. Liam needs a financial management tool that offers flexibility, helps him manage cash flow fluctuations, and prepares him for tax season.

Unpredictable Income: Liam’s income can vary significantly from month to month, depending on the availability of writing projects. This makes it difficult to budget effectively and maintain financial stability. During slow periods, he might struggle to cover basic living expenses or essential business costs.

Overspending: During high-earning periods, Liam might be tempted to overspend without considering future income fluctuations. This can lead to financial strain during lean times.

Tax Preparation: Tax season can be a stressful time for Liam, especially with an inconsistent income stream. Tracking down receipts and categorizing expenses for tax deductions becomes cumbersome without a centralized system.

Cash Flow Forecasting & Insights: Oxygen’s customizable dashboards allow Liam to visualize his income trends over time. He can see seasonal patterns and forecast future cash flow based on historical data and upcoming projects. This empowers Liam to plan for lean periods and make informed spending decisions.

Early Access to Earned Income (Optional Feature): Oxygen offers an optional feature for early access to earned income on completed projects. This can bridge financial gaps between projects and provide Liam with the flexibility to cover unexpected expenses or manage uneven income cycles.

Tax Optimization Tools: Oxygen provides tax optimization tools to help Liam categorize expenses relevant to his freelance work, like home office equipment, software subscriptions, and travel for client meetings. He can generate detailed reports for his accountant, streamlining tax preparation and maximizing potential deductions.

Improved Financial Stability: With cash flow forecasting and insights, Liam can make informed decisions about his spending and avoid overspending during high-earning periods. This allows him to build a financial safety net and weather periods of low income with less stress.

Flexibility and Peace of Mind: Early access to earned income provides Liam with peace of mind and the ability to manage unexpected expenses without jeopardizing his financial health.

Simplified Tax Preparation: Oxygen streamlines Liam’s tax preparation process by helping him track and categorize business expenses efficiently. This saves him time and money during tax season and ensures accurate tax filing.

+1 (704) 430-6476

info@scumscenariomaster.com

Copyright © 2024 Apprentistly