Financial stress can be a silent drain on your workforce, impacting employee morale, productivity, and even absenteeism. Today’s businesses need a powerful solution to address this challenge.

Grain is a revolutionary financial wellness platform designed to equip your employees with the tools and resources they need to achieve financial security. By investing in your employees’ financial well-being, Grain empowers them to focus on their work, leading to a more productive, engaged, and successful workforce.

Why Choose Grain?

Grain provides unmatched flexibility to meet your specific needs and budget. Integrate Grain seamlessly with your existing HR systems for a streamlined experience, or offer it as a standalone benefit for employee independence.

Grain scales effortlessly alongside your business. The platform can handle an increasing number of employees as you grow, ensuring everyone has access to the program's benefits. It also allows you to upgrade your plan and add features as your company evolves and requires more advanced financial wellness functionalities.

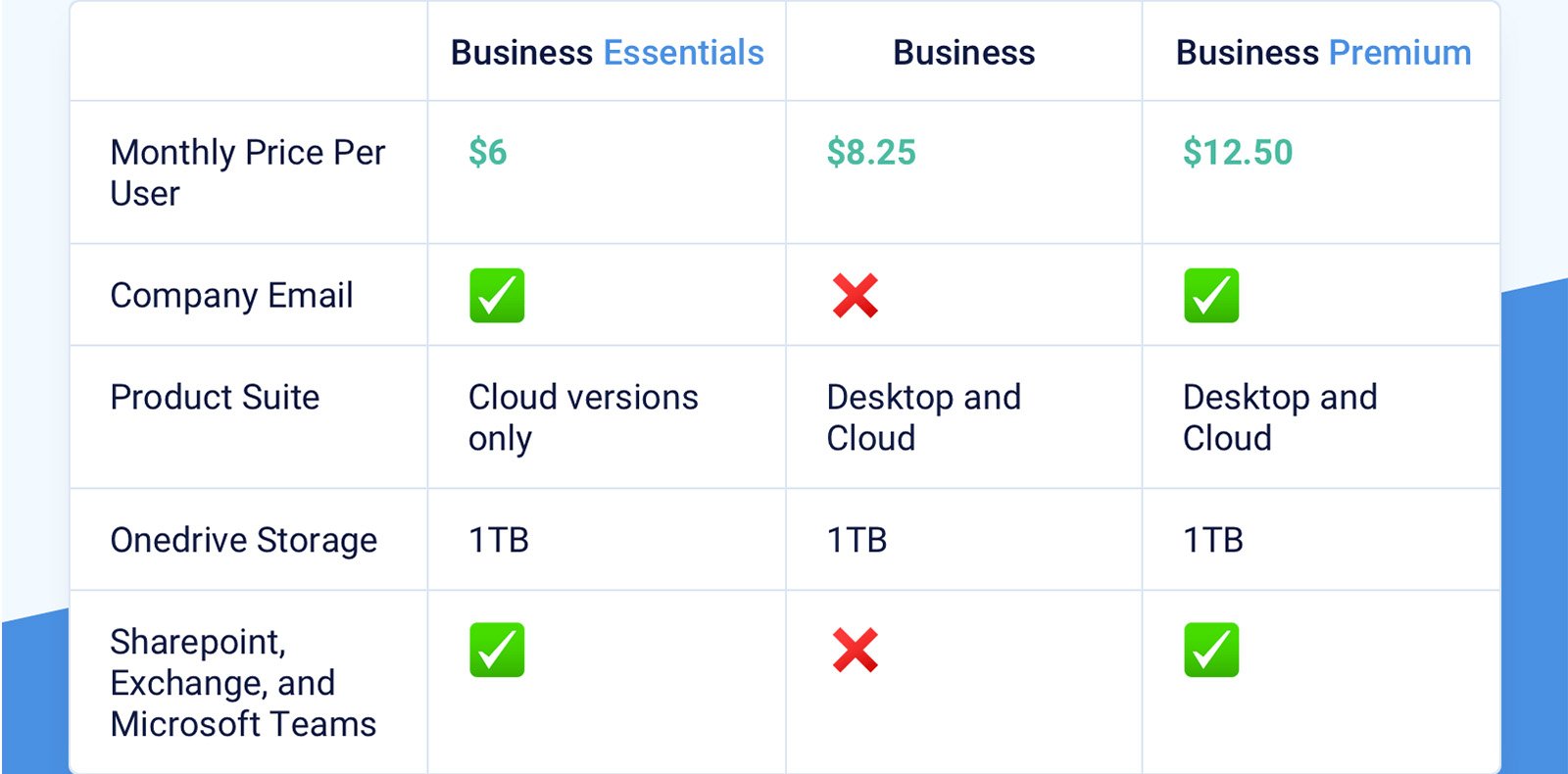

Grain prioritises affordability with competitive pricing models to suit your budgetary constraints. Choose a tiered pricing plan with the features that best align with your budget and workforce needs. Remember, Grain's cost-effectiveness translates to a return on investment (ROI) through improved employee morale, productivity, and reduced absenteeism.

Grain prioritizes user-friendliness with an intuitive interface that's easy to navigate on any device. The platform avoids overwhelming financial jargon and is designed to be accessible to employees of all financial literacy levels, from those struggling with basic budgeting to those seeking more advanced financial guidance.

Grain integrates seamlessly with popular payroll and benefits platforms you already use. This streamlines implementation by eliminating duplicate data entry and creating a unified employee experience. Employees won't need to manage multiple logins or navigate between different platforms to access their financial wellness benefits.

Grain's strength lies in its ability to complement your existing HR and financial tools, creating a holistic financial wellness ecosystem for your employees. Here are some key integration possibilities to consider:

Unveiling Canva Design Like a Pro on a Budget In today's digital age, a captivating online presence is crucial for businesses of all sizes. But.

Unveiling MailChimp Elevate Your Email Marketing Game on Any Budge In today’s digital landscape, effective email marketing is vital for businesses to connect with their.

Integrate Grain with your payroll platform to automate benefit contributions and streamline employee data transfer. This eliminates manual data entry for HR teams and ensures employees have immediate access to Grain upon enrollment.

Integrate Grain with your existing benefits administration platform. This allows employees to view and manage all their benefits (health insurance, retirement plans, etc.) alongside their financial wellness resources within a single platform, creating a more centralized and user-friendly experience.

Consider integrating Grain with financial data aggregation services. This allows employees to securely connect their bank accounts and credit cards to Grain. The platform can then automatically import financial data, eliminating the need for manual entry and providing employees with a more comprehensive view of their overall financial health.

Grain offers access to financial coaches. However, you might consider integrating with additional financial coaching platforms for a wider range of specialized expertise. This could allow employees to connect with coaches who have specific experience in areas like student loan repayment, retirement planning, or investing.

If your company offers an Employee Assistance Program (EAP), consider integrating it with Grain. This would create a more robust support system for employees facing financial challenges. Employees could access financial wellness resources through Grain while also having the option to connect with EAP counselors for personalized guidance on managing debt, budgeting, or other financial concerns.

By integrating Grain with these tools, you can achieve several benefits:

A Visual Guide

Scene 2: Integration Possibilities

Scene 3: Employee Enrollment

Scene 4: Employee Sign Up

Grain goes beyond basic budgeting templates.

Connect your bank accounts securely to automatically import transactions and categorize them for effortless expense tracking.

Create realistic and flexible budgets based on your income and spending habits. Set spending goals for different categories and track your progress over time.

Simulate different financial scenarios (e.g., increased income, unexpected expenses) to see how your budget might adjust.

Set specific savings goals (e.g., emergency fund, down payment on a house) and track your progress with motivational visualizations.

Eliminate the guesswork and stress of managing multiple debts.

Grain analyses your debts and suggests a strategic repayment plan, focusing on high-interest debts first to save you money in the long run.

Schedule automatic transfers to your creditors, ensuring timely payments and avoiding late fees.

Stay motivated with clear visualisations of your debt repayment progress. See how much you've paid down and how much closer you are to becoming debt-free.

Get personalised guidance and support from certified financial coaches.

Connect with a coach via chat or video call to discuss your specific financial goals and concerns.

Receive personalised advice tailored to your financial situation, whether you're struggling with debt, planning for retirement, or looking to invest.

Build a relationship with your coach for long-term financial guidance and accountability.

Empower yourself with financial knowledge.

Access a wide range of educational resources, including articles, videos, and interactive tools covering various financial topics.

Grain personalizes learning recommendations based on your financial literacy level and specific needs.

Engage with quizzes, calculators, and budgeting templates to solidify your financial understanding.

Grain prioritises user-friendliness with a clean and intuitive interface:

A clear and well-organised menu structure allows for effortless navigation on any device – desktop, laptop, or smartphone.

Financial information comes alive with clear charts, graphs, and progress bars, making it easy to understand your financial health at a glance.

Personalise your dashboard to highlight the features and information you use most frequently.

Grain caters to a diverse workforce by offering support in multiple languages.

Get help through phone calls, emails, and live chat options to choose the method that best suits your needs.

Grain's customer support team is readily available to answer questions, troubleshoot issues, and ensure a smooth user experience.

Access contextual help articles and FAQs directly within the Grain app for quick solutions to common questions.

Ideal for small businesses with basic budgeting and financial education needs.

Provides additional features like automated debt repayment tools and access to financial coaches for mid-sized businesses.

A comprehensive solution for large companies, offering advanced functionalities and dedicated customer support.

Grain understands that budget transparency is crucial. While they don't publicly advertise specific pricing plans, Grain offers various options tailored to your company's size and desired features. Here's how you can determine the right fit for your business:

Grain’s financial wellness platform offers a powerful solution for businesses of all sizes and industries. Here’s a closer look at how Grain can address specific challenges faced by businesses in different sectors

High employee turnover and absenteeism due to financial stress can significantly impact customer service and overall daycare quality.

Debt Management Tools: Help employees tackle debt, reducing financial anxiety and improving overall well-being. This can lead to increased focus, better job satisfaction, and lower absenteeism rates.

Emergency Savings Plans: Grain empowers employees to build emergency savings, ensuring they have a financial safety net to cover unexpected expenses and avoid missing work due to financial emergencies.

Improved Customer Interactions: Financially secure and stress-free employees are more likely to provide exceptional care for children, leading to higher customer (parent) satisfaction and loyalty.

Benefits of Grain for Busy Bees Daycare and Employees:

Reduced Turnover: Improved employee financial well-being can lead to a more stable and committed workforce.

Enhanced Customer Service: Financially secure employees can provide more positive and focused interactions with parents and children.

Improved Employee Morale: Grain empowers employees to take control of their finances, reducing stress and fostering a more positive work environment.

Financial Security: Employees gain access to tools and resources to manage debt, build savings, and plan for the future.

Attracting and retaining top talent in a competitive tech job market requires offering a comprehensive benefits package that goes beyond traditional health insurance.

Competitive Benefits Package: By offering Grain’s financial wellness program, Technovation Inc. can differentiate themselves and attract candidates who value financial security and a holistic approach to well-being.

Financial Literacy Education: Grain’s educational resources empower employees to make informed financial decisions, leading to a more financially responsible and engaged workforce.

Improved Employee Retention: Investing in employee financial wellness demonstrates that Technovation Inc. cares about its employees’ long-term well-being, fostering loyalty and reducing turnover.

Talent Acquisition: A comprehensive benefits package that includes financial wellness can attract top talent in a competitive market.

Financially Savvy Workforce: Grain empowers employees to make informed financial decisions, leading to a more responsible and engaged workforce.

Reduced Turnover: Investing in employee financial well-being fosters loyalty and reduces turnover costs.

Financial Confidence: Employees gain access to tools and resources to manage their finances effectively and achieve their financial goals.

Manufacturing jobs often come with student loan debt or require long-term financial planning for retirement. Financial stress can impact employee morale and productivity.

Student Loan Repayment Strategies: Grain offers tools and personalized guidance to help employees develop effective strategies to manage and repay student loan debt.

Retirement Planning Resources: The platform provides educational resources and coaching to empower employees to plan proactively for a secure retirement, reducing financial anxiety and improving overall well-being.

Boost in Morale and Productivity: By addressing employees’ financial concerns, Grain helps alleviate stress and improve focus, leading to a more productive and motivated workforce.

Improved Employee Morale: Addressing financial concerns can reduce stress and create a more positive work environment.

Increased Productivity: Financially secure employees are often more focused and productive at work.

Reduced Financial Stress: Employees gain access to tools and resources to manage debt, build savings, and plan for the future.

These are just a few examples. Grain’s comprehensive features and functionalities can be tailored to address the specific needs of businesses across various industries, ultimately leading to a healthier, happier, and more productive workforce.

+1 (704) 430-6476

info@scumscenariomaster.com

Copyright © 2024 Apprentistly